What Factors Affect Your Credit Score?

If you're planning to take out a loan, your credit score may play a major impact in your success. Lenders may use the credit score to determine whether you can repay the loan. The credit score may also determine the interest rate of your loan. So, what factors may determine your credit score? Read on to learn about the various factors that influence a credit score

Payment History

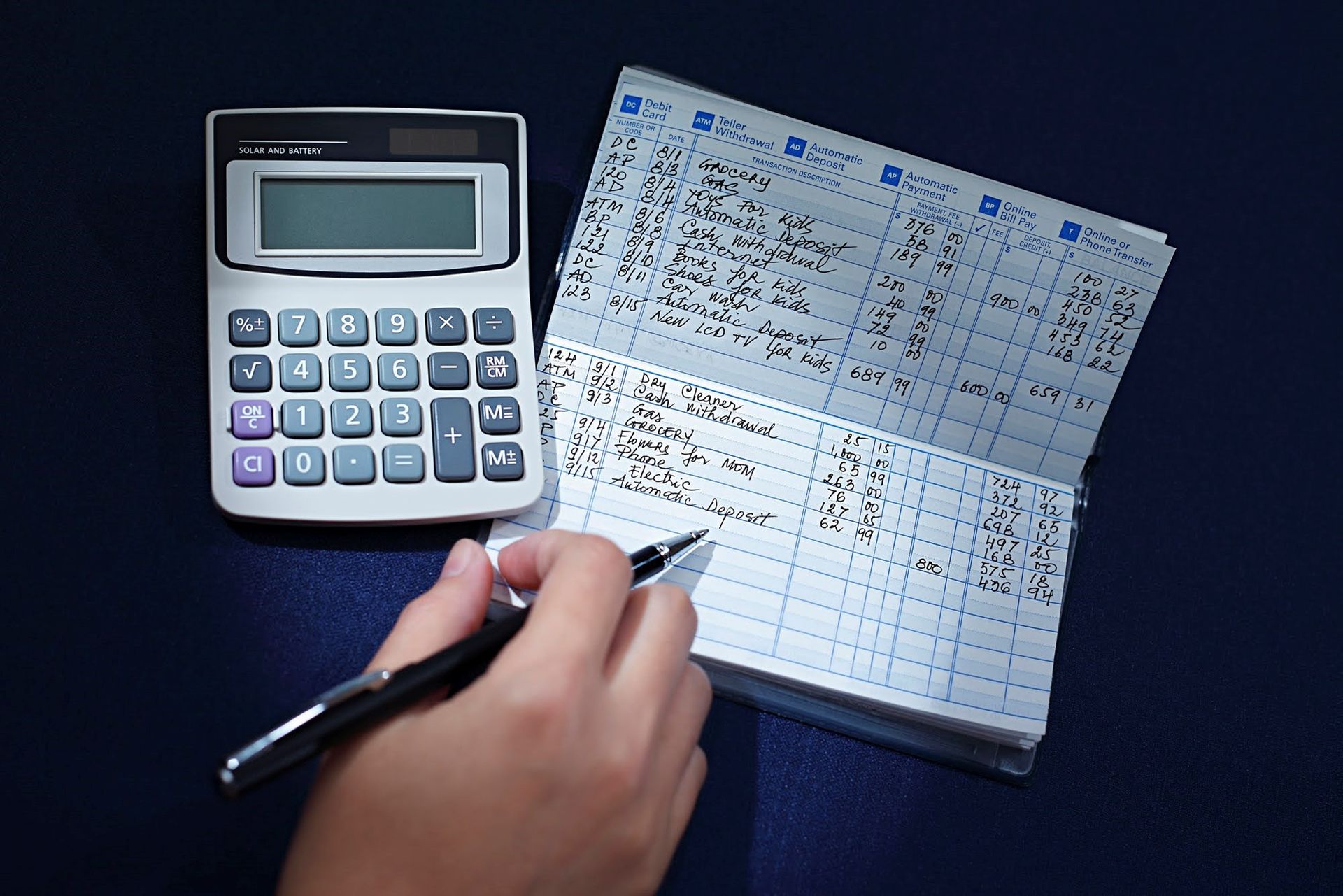

Since lenders want to know if they can trust you, they may look at your previous repayments. For example, people who pay their bills on time may have a higher credit score, while those who pay late have a low score. Similarly, if any of your bank accounts have ended up in collections, you are a red flag to any potential lender. The same can happen if you have been involved in bankruptcy or foreclosure.

Credit Usage

Credit usage is a crucial factor and one that you can easily modify to boost your credit score. If the ratio between your outstanding debts and credit limit is low, your credit score will be high. Therefore, you hurt your credit score whenever you max out credit cards. Also, failure to pay part of the balance reduces the utilization ratio.

Usually, credit usage refers to your overall utilization rates on all financial accounts, but rates in individual accounts are essential as well. When you have many accounts with balances, you show that you are a financial risk. The solution is to pay your bills in advance, even well before they are due. That way, credit card issuers will always send early reports of your payment to credit bureaus.

Number of Credit Inquiries

When you conduct a credit check, the inquiry becomes part of your credit report. A few inquiries are not a problem, but multiple credit checks over a short time can deduct points from your credit score. Thus, only do a credit check if it's absolutely necessary.

Fortunately, you can still get away with many inquiries since only checks from the past year impact your credit score. In addition, the reports will disappear from your credit score after two years have elapsed. If you check your credit score on your own, the check won't affect the score. The impact only happens when a third party requests your credit report.

Debt

While having debts isn't a sign of a high-risk borrower, your debt balance can make it hard to meet your monthly payment obligations. Sometimes, debt can become too much and affect your credit score. The main determining factor is the amount that you owe on all accounts. Even if you pay credit cards on time, your credit report for that month may still indicate a balance.

Credit Age

How long you have had your debt affects your credit score. If you have been repaying your debt for a long time without any slip-ups, your credit score may get higher. Lenders will believe that you will continue the same positive pattern for a long time in the future. Unfortunately, credit age only benefits older people since younger people may have taken their loans recently.

Are you afraid that your credit score is preventing you from getting a loan? Ardmore Finance offers loans at favorable terms and rates. We provide consumer installment loans with equal monthly payments. Contact us to get a loan that your budget can afford.