How to Efficiently Manage Your Installment Loan

Managing an installment loan efficiently is crucial for achieving financial stability. Understanding how to handle these loans not only ensures timely repayments but also enhances your overall financial health. Installment loans provide the advantage of predictable monthly payments, making them less stressful to manage compared to other forms of credit. By strategically managing your installment loan, you can make the most of its benefits without falling into common pitfalls. Here, you'll find essential tips to guide you on this path.

Understand Your Loan Terms

First, familiarize yourself with the terms of your installment loan. Knowing the interest rate, repayment schedule, and any associated fees is essential for managing your loan efficiently. This understanding helps you plan your finances better and avoid unexpected surprises. Ensure that you fully comprehend the loan services offered by your lender, as these can significantly impact your repayment strategy.

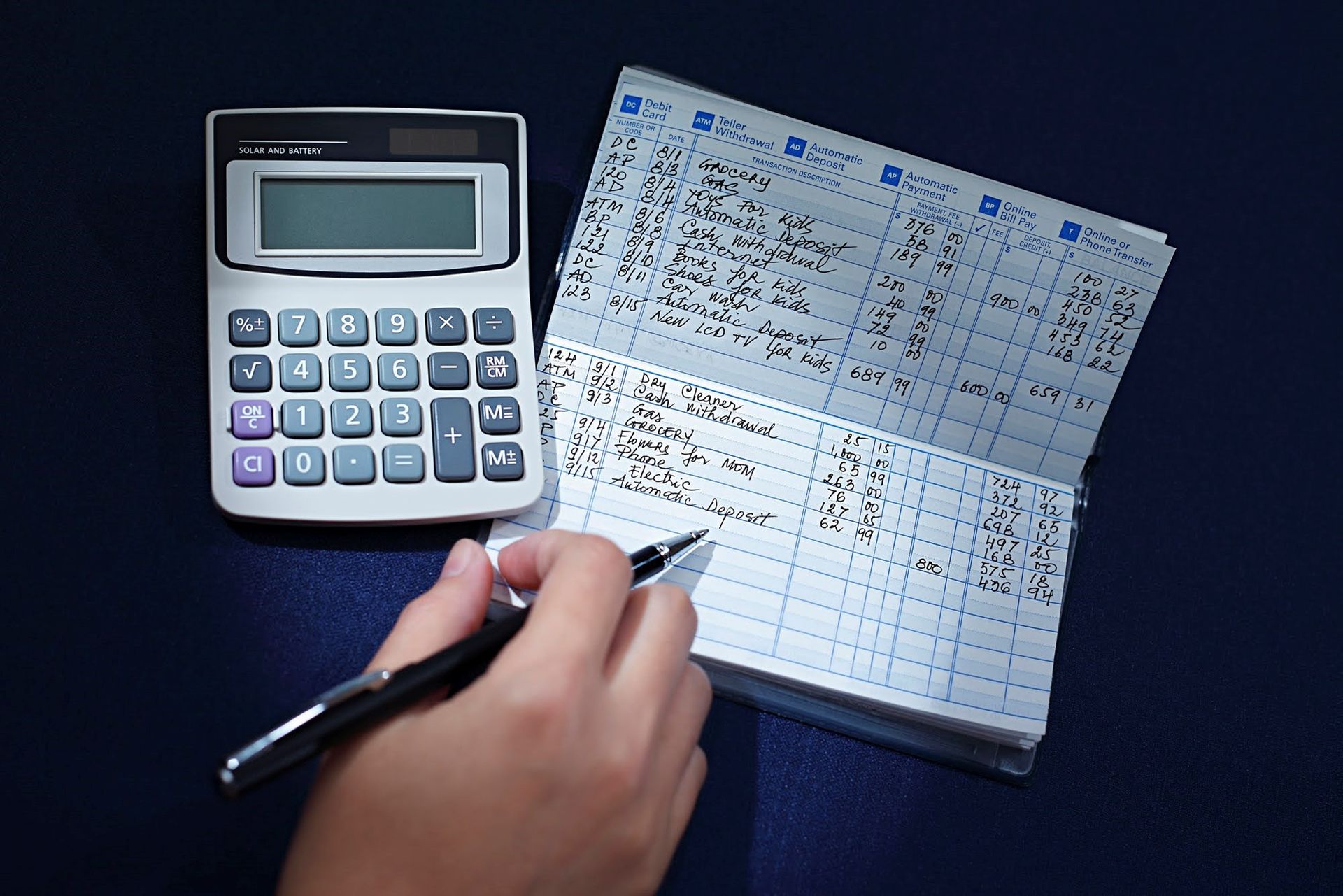

Budget Wisely

Creating a budget is a fundamental step in managing your installment loan efficiently. Begin by listing all of your income sources and monthly expenses, including your loan payment. Allocate enough funds each month to cover the loan while ensuring you have money left for essential needs. A well-planned budget helps you track your spending habits and find areas where you can cut costs. This discipline keeps you on track and reduces the risk of late payments.

Set Up Automated Payments

Consider setting up automated payments for your installment loan. This strategy ensures you never miss a payment, protecting your credit score from the negative impact of late fees. Automation also saves you time and mental energy, allowing you to focus on other financial goals. Be sure to have sufficient funds in your account each month to cover the payment to avoid overdraft charges.

Build an Emergency Fund

An emergency fund acts as a financial buffer, providing security in case of unexpected expenses. By allocating a portion of your income to this fund, you safeguard your ability to make loan payments even when unforeseen costs arise. Aim to save enough to cover three to six months' worth of expenses to ensure you remain financially stable during challenging times.

Communicate With Your Lender

Open communication with your lender can be beneficial if you encounter difficulties in making payments. Lenders often offer loan services designed to accommodate borrowers facing temporary financial setbacks. By discussing your situation proactively, you may be able to negotiate more favorable terms, such as a temporary reduction in payments or an extended repayment period. Effective communication can prevent negative consequences and help maintain a positive relationship with your lender.

Monitor Your Credit Score

Keeping an eye on your credit score is vital when managing an installment loan. A healthy credit score opens doors to better loan services in the future, such as lower interest rates and more favorable terms. Regularly reviewing your credit report enables you to identify any discrepancies and take corrective action promptly. Paying your loan on time contributes positively to your credit score, reinforcing your financial credibility.

Avoid Taking on Additional Debt

While managing your installment loan, exercise caution when considering additional borrowing. Accumulating more debt can strain your finances and complicate your ability to meet existing obligations. Focus on repaying your current loan before pursuing new credit opportunities. By prioritizing debt reduction, you enhance your financial stability and reduce stress.

Plan for Loan Repayment Completion

Planning for the completion of your loan repayment is a strategic move towards financial freedom. As you approach the end of your loan term, reassess your financial goals and consider redirecting the funds used for loan payments toward savings or other investments. This proactive approach keeps you focused and motivated, setting the stage for sustained financial success.

Managing your installment loan efficiently requires a clear understanding of your loan terms, disciplined budgeting, and proactive communication with your lender. By implementing these strategies, you can maintain financial stability and build a positive credit history. Remember to monitor your credit score, avoid unnecessary debt, and plan for the future as you work towards completing your loan repayment. These practices not only enhance your financial health but also pave the way for achieving long-term financial goals. For more information, contact us today.