Understanding Creditworthiness

Creditworthiness is an essential aspect of personal and business finance. It measures how reliable a borrower is in repaying a loan or debt. Lenders use this metric to determine the likelihood of receiving their money back when they lend funds to an individual or business.

Understanding your creditworthiness is crucial in securing financial assistance or funding. As a potential customer, it is essential to know how creditworthiness is calculated and what factors affect your rating. This blog post will explore the basics of creditworthiness and provide you with a guide to help you improve your credit rating.

What Is Creditworthiness?

Creditworthiness is your ability to pay back a loan or debt on time and in full. It is determined by the lender's evaluation of your past financial behavior, including your credit history, income, debt-to-income ratio, and other factors. Your creditworthiness rating is represented by a score ranging from 300 to 850, with higher scores indicating a more creditworthy borrower. The credit scores are based on the information contained in your credit report, provided by the three credit reporting bureaus: Experian, Equifax, and TransUnion.

What Factors Affect Your Creditworthiness?

Several factors could impact your creditworthiness, including your payment history, credit utilization, length of credit history, and types of credit used. Your payment history reflects how well you have managed your credit accounts, including whether you have missed payments or defaulted on loans.

Credit utilization is the amount of debt you owe in comparison to your available credit limit. A high credit utilization rate may indicate that you rely heavily on credit and may be a higher risk to lenders. The length of your credit history represents the amount of time you have used credit, with a longer credit history typically indicating a more reliable borrower. Finally, the types of credit used refer to the variety of credit accounts, such as credit cards, loans, or mortgages, that you have used in the past.

How To Improve Your Creditworthiness?

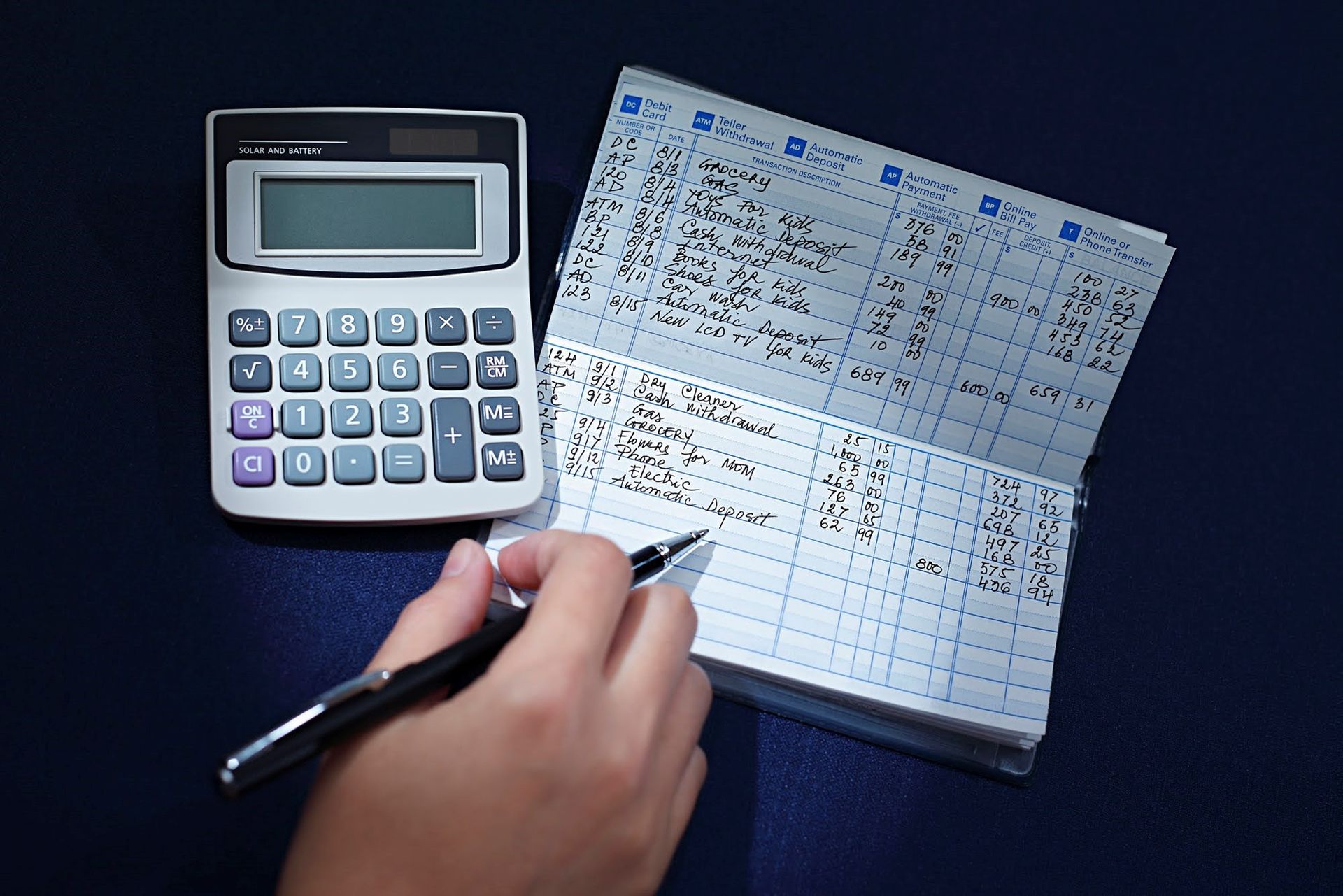

Improving your creditworthiness can take time, but there are several steps you can take to positively impact your credit rating. Start by reviewing your credit report for any errors. Dispute any errors you find with the credit reporting bureau. Create a budget and payment plan to ensure timely payment of all your outstanding debts. Keep your credit utilization low by paying off outstanding balances and reducing the number of new credit applications. Finally, limit the number of new credit accounts and ensure timely repayment of any new credit.

Why Is Creditworthiness Important?

Creditworthiness is vital in determining your eligibility for financial assistance or funding. An excellent credit rating could improve your chances of securing loans, credit cards, mortgages, and other forms of funding. It could also result in lower interest rates and better repayment terms on any credit you secure, leading to significant savings. Additionally, it could impact your chances of getting hired, as some employers may check your creditworthiness as part of the hiring process.

How Can You Monitor Your Creditworthiness?

Monitoring your creditworthiness regularly is crucial to ensure that there are no errors or inaccuracies in your credit report. You can receive your credit score and credit report for free from the three credit reporting bureaus once a year. However, paying for a credit monitoring service can provide you with more frequent updates and alerts about any changes that could impact your credit score.

Creditworthiness is an integral aspect of personal and business finance, and understanding how to maintain and improve it is essential for potential customers. By understanding creditworthiness, you can improve your chances of securing funding and better repayment terms, leading to significant financial savings. Contact us at Ardmore Finance to learn more about creditworthiness.