3 Strategies to Secure a Personal Loan With Poor Credit

Banks, credit unions, and other lenders are less likely to lend you money if your credit history isn't stellar. However, there are ways to secure a personal loan even with a low credit score.

This blog post will discuss a few strategies to get a personal loan, even with bad credit.

1. Ensure You Can Afford the Loan

Even with a bad credit score, some lenders are more likely to approve loan applications if you can demonstrate that you can comfortably afford the loan.

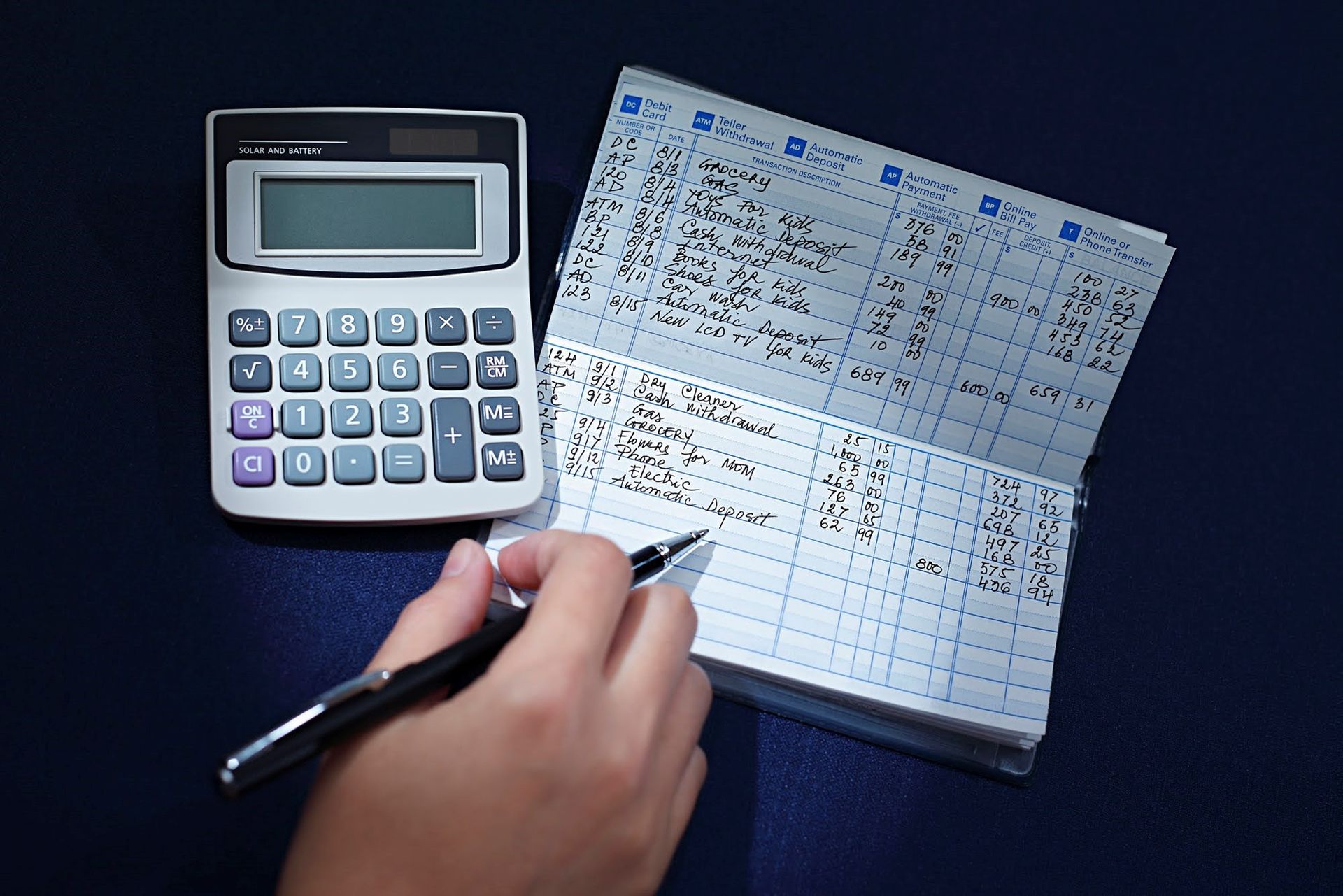

To meet this requirement, prepare a budget that shows your income and expenses. Include any monthly payments you already make, such as credit card debt and student loan payments. If you can demonstrate that you have enough income to cover the loan payments and other expenses, you may be more likely to secure a loan.

In addition, make sure to provide evidence of steady employment or other forms of income. If you're employed, lenders may look for proof that your job is stable. A steady work and income history demonstrate that you can make loan payments on time, even with a low credit score.

Don't forget to include any assets you own, such as a home, car, or investments. Lenders often prefer to loan money to someone with assets they can use as collateral, so you are more likely to get a loan if you provide proof of ownership.

2. Find a Co-Signer

If your credit score is too low to qualify for a loan on your own, you can ask someone with good credit to co-sign the loan. A co-signer agrees to assume responsibility for the loan if you fail to make payments. But they should have a high credit score and a good credit history. The co-signer should also demonstrate that they can afford the loan payments in addition to their own bills and expenses.

Remember that when your co-signer agrees to co-sign the loan, they take on considerable financial risk. If you default on the loan or make late payments, this move could impact their credit score. So make sure your co-signer understands the risks before they sign off on the loan. And if you want to protect the co-signer's credit score, make the loan payments on time.

Consider your relationship with your co-signer beforehand. If your relationship isn't strong enough to handle the stress of a loan, you might want to look for other options. This way, if something unexpected happens and you are unable to make the payments, your relationship with the co-signer will still remain intact. Just remember to carefully consider your options before you commit to any plan.

3. Get Prequalified

A loan prequalification is an estimate of the loan amount you may be able to secure. This estimate takes into account your credit history, income, debts, and other factors. If you can get prequalified for a loan, you effectively prove to lenders that you're a good candidate for a loan, even with poor credit.

When you get prequalified, the lender also lets you know what your pre-determined interest rate might be. This information can help you plan for the loan and decide if the terms are right for you.

Remember that a prequalification doesn't always guarantee that you'll get approval for the loan. However, a loan prequalification tells lenders that you're a strong candidate, which could increase your chances of approval.

At Ardmore Finance, we understand the impact a bad credit score can have on loan applications. We are here to help you find the right personal loan for your financial situation. Contact us today to learn more about how we can help you get a loan with bad credit.